who pays sales tax when selling a car privately in michigan

Who pays sales tax when selling a car privately Uncategorized February 7 2021 Uncategorized February 7 2021. Michigan is one of the few states that do not have any additional local or county tax.

When you sell your car you must declare the actual.

. For example if you decide to sell. Private party sales within most states are not exempt from. According to the Florida Department of Highway Safety its best to complete the transaction at the tax collectors office.

To calculate how much sales tax youll owe simply. The Michigan Department of Treasury. The buyer will have to pay the sales tax when they get the car registered under their name.

Nov 3 2022 2 min read. The state sales tax on a car purchase in Michigan is 6. To calculate the sales tax on your vehicle find the total sales tax fee for the city.

The buyer will pay sales tax on the purchase price of the. All of the conditions that apply when buying a vehicle from an individual in a private sale also apply when buying inheriting or being gifted a vehicle from a family member. However you do not pay that tax to the car dealer or individual selling the car.

The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle. Per the Daily Herald if you live inside the city of Chicago you will be charged an additional city sales tax of 125. When you sell a car who pays taxes.

The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle. Multiply the vehicle price after trade-in andor incentives by the. The buyer is responsible for paying the sales tax.

However if you bought it for. The buyer will have to pay the sales tax when they. However you do not pay that tax to the.

Texans who buy a used vehicle from anyone other than a licensed vehicle dealer are required to pay motor vehicle sales tax of 625. Start and Finish in Minutes. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to.

All tax rates in Michigan are at 6. Also if the dealership handles your vehicles documentation. If you sell a 2017 Mercedes and claim a sale price of 15000 or less you will have to pay tax on the 15000 or less val-uation.

But a car lien may affect the auto insurance coverage youre required to carry as well as the sales process if you decide to sell your car. Private vehicle transactions in Michigan require a 6 tax due on the full purchase price or fair market value of the vehicle whichever is greater. With any private car sale in the state buyers must submit Tax Form RUT-50 and pay the 625 state sales tax to the county tax collector.

If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale. As of 2020 New York has a car tax rate of 4 percent plus local taxes whereas next-door neighbor Massachusetts has a state car tax rate of 625 percent with some local. Title transfers must take place within 30 days from the date of sale otherwise a late penalty fee will be charged.

How To Register For A Sales Tax Permit In Michigan Taxvalet

What Do I Do With My Plates After I Sell My Car Sell My Car In Chicago

Michigan Laws About Private Used Car Sales It Still Runs

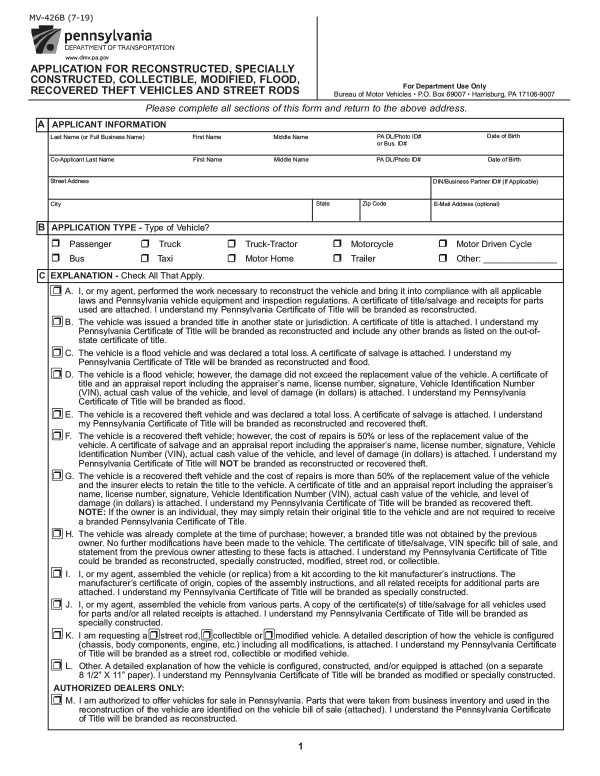

Bills Of Sale In Pennsylvania All About Pa Forms And Facts You Need

California Used Car Sales Tax Fees 2020 Everquote

Do I Need To Pay Taxes On Private Sales Transactions Rocket Lawyer

Buying A Car Without A Title What You Should Know Experian

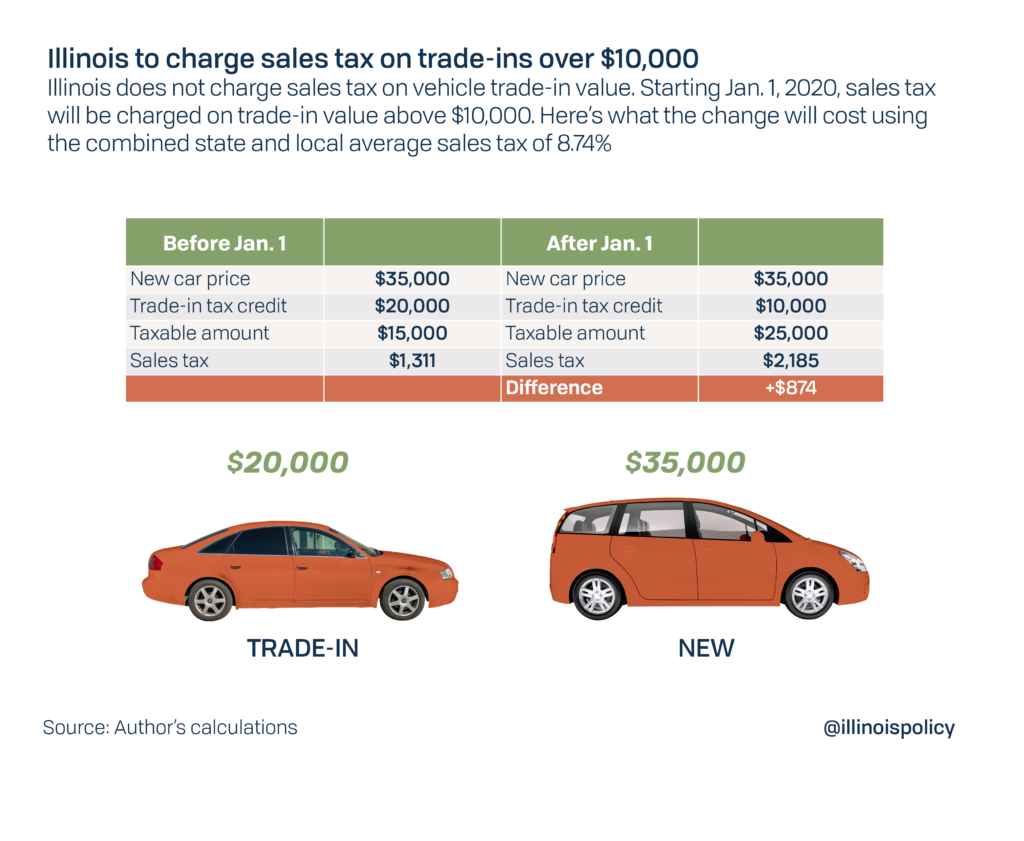

Michigan Sales Tax On The Difference For Trade Ins Means More Money For You

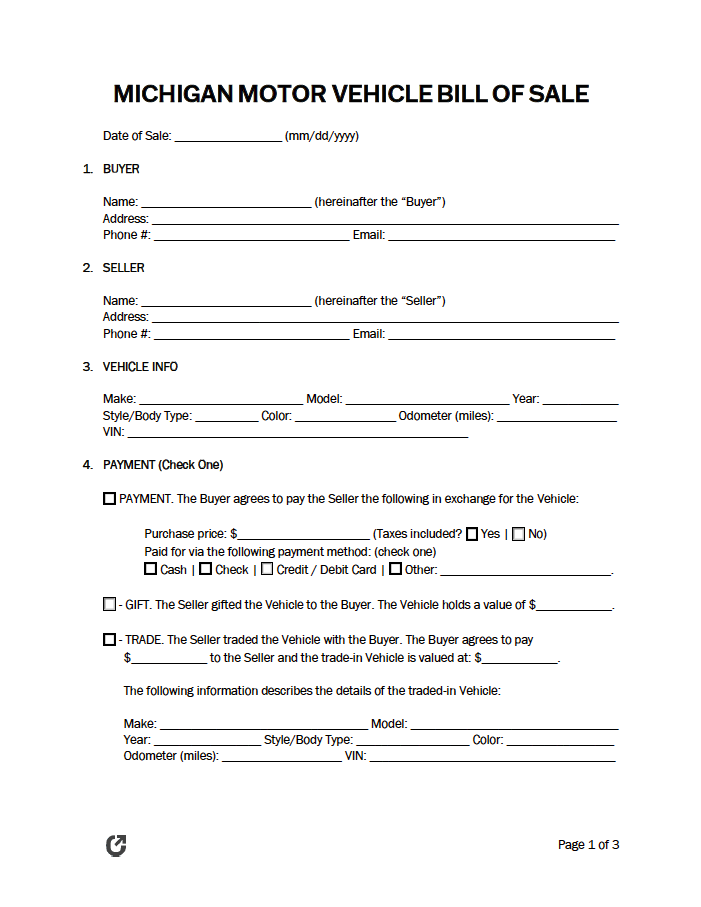

Free Michigan Bill Of Sale Forms 5 Pdf Word Rtf

Car Tax By State Usa Manual Car Sales Tax Calculator

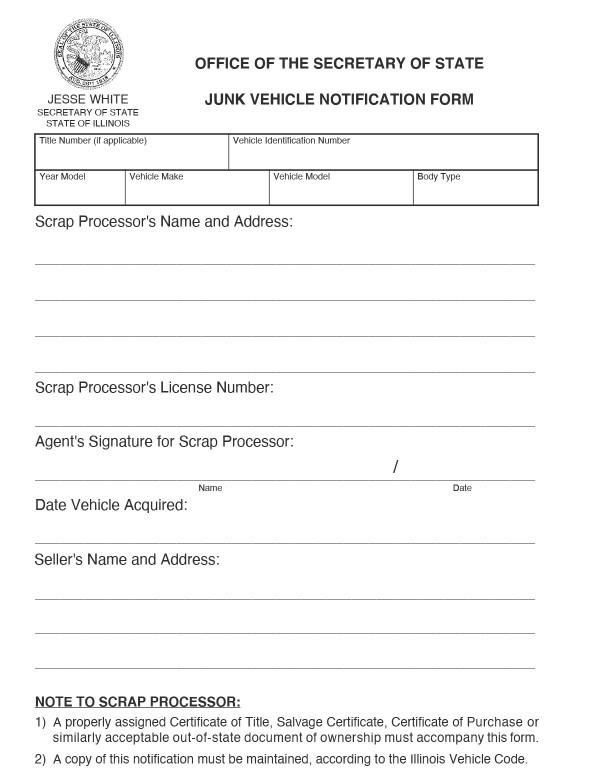

Illinois Bill Of Sale Forms And Registration Requirements

New And Used Car Sales Tax Costs Examined Carsdirect

Free Michigan Motor Vehicle Bill Of Sale Form Pdf Word Rtf

How To Transfer Car Insurance Driving Credentials To A New State Moneygeek Com

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes

Free Michigan Motor Vehicle Bill Of Sale Pdf Word Eforms

Illinois Imposing Car Trade In Tax On Jan 1 Dealers Call It Double Taxation

Bill Of Sale Michigan Fill Out Sign Online Dochub

How To Qualify For The Vehicle Sales Tax Deduction Carvana Blog